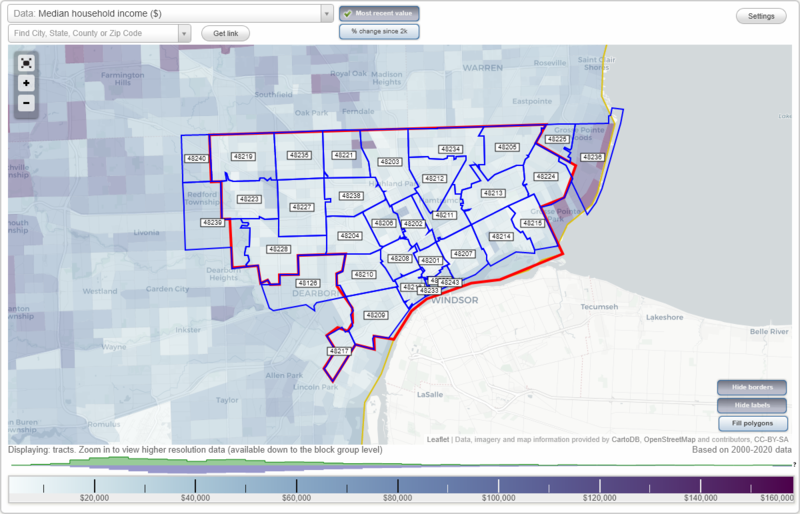

michigan property tax rates by zip code

We are open Monday through Friday from 830 am to 430 pm. Michigans effective real property tax rate is 164.

Property Tax Calculator Estimator For Real Estate And Homes

The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance.

. The money collected is generally used to support community safety schools. 2021 Millage Rates - A Complete List. The Millage Rate database and.

The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to. 2020 Millage Rates - A Complete List. Median Annual Property Tax Payment Average Effective Property Tax Rate.

In the city of Kalamazoo the tax rate on principal residences is anywhere from 4813 to 5033 mills. Estimate Your Property Tax. Michigan Taxes tax income tax business tax sales tax tax form 1040 w9 treasury withholding.

Median property tax is 214500. Information regarding personal property tax including forms exemptions and information for taxpayers and assessors regarding the Essential Services Assessment. Our dataset includes all local sales tax jurisdictions in Michigan at state county city and district levels.

Property Tax Calculator. 2019 Millage Rates - A Complete List. That updated value is then multiplied times a combined levy from all taxing entities together to set tax due.

2018 Millage Rates - A Complete List. Enter the zip code in which the property is located to estimate your property tax. Property taxes in America are collected by local governments and are usually based on the value of a property.

All groups and messages. 84 rows Michigan. The median property tax in Macomb County Michigan is 2739 per year for a home worth the median value of 157000.

Median property tax is 214500. Each mill represents 1 of tax for every. The tax data is broken down by zip code and additional locality information location.

Property Tax Forfeiture and Foreclosure Reports and Legal collapsed link. Send your check money order to. But rates vary from county to county.

162 of home value. Here is a listing of the communities with Michigans lowest millage rates based on the state Department of Treasurys 2016 numbers. In fact there are two different numbers that reflect your homes value on your Michigan real property.

What is the most recent assessed value of your property. Rate is 1116 mills in Ecorse schools. 2021 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP Lee Twp 031120 ALLEGAN PUBLIC SCHOO 319946 499946 259946 379946 359946 539946.

Tax amount varies by county. The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000. An appraiser from the countys office establishes your propertys market value.

Macomb County collects on average 174 of a propertys. This interactive table ranks Michigans. Property Tax Forfeiture and Foreclosure.

Lansing Michigan Mi Zip Code Map Locations Demographics List Of Zip Codes

Property Taxes By County Interactive Map Tax Foundation

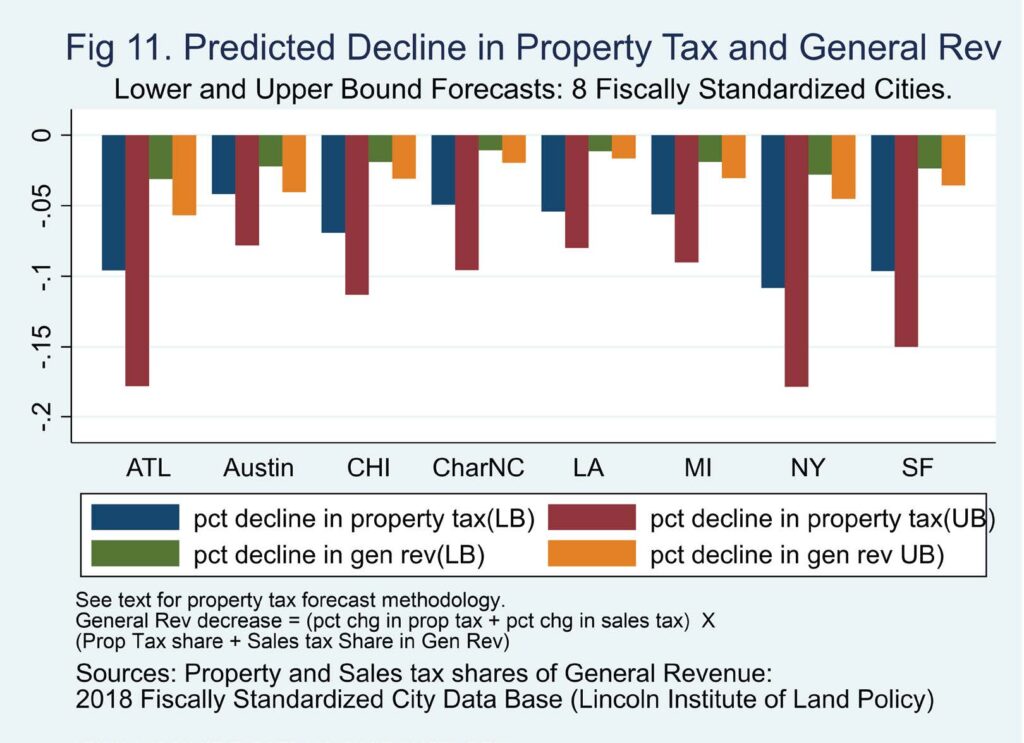

The Impact Of Work From Home On Commercial Property Values And The Property Tax In U S Cities Itep

Livingston County Treasurer Treasurer

How To Calculate Property Taxes In Michigan Maiga Homes Real Estate Faq S Youtube

Detroit Michigan Mi Zip Code Map Locations Demographics List Of Zip Codes

Property Taxes By State Which Has The Highest And Lowest

Tax Bill Information Macomb Mi

Sales Taxes In The United States Wikipedia

How Home Improvements Cause A Property Tax Increase Nerdwallet

Michigan Sev Values Tax Burdens And Other Charts Maps And Statistics

How To Calculate Michigan Property Taxes On Your Investment Properties

Redford Township Government Departments Assessor About The Assessing Office

Where Are The Lowest Property Taxes In Florida Mansion Global

How Much Florida Homeowners Pay In Property Taxes Each Year Florida Thecentersquare Com

Michigan 2022 Sales Tax Calculator Rate Lookup Tool Avalara

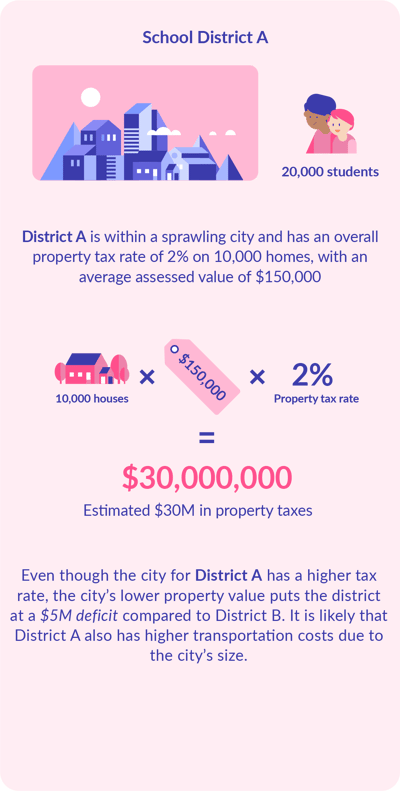

How State Local Dollars Fund Public Schools

Who Pays Downtown Detroit Property Taxes Numbers Hold Surprises

:max_bytes(150000):strip_icc()/best-and-worst-states-for-sales-taxes-3193296_final_CORRECTED-4d56f8efcd264f53981a40415c0e6de3.png)