vermont income tax refund

California Income Tax Rate 2020 - 2021. South Carolina Tax Brackets 2020 - 2021.

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Using deductions is an excellent way to reduce your Massachusetts income tax and maximize your refund so be sure to research deductions that you mey be able to claim on your Federal and Massachusetts tax returns.

. Individual Income Tax Filing. All Other Business Taxes. Sales and Use Tax.

The 2022 tax season officially opened on January 24. You may check the status of your refund on-line at Massachusetts Tax CenterYou can start checking on the status of your return within 24 hours after we have received your e-filed return or 4 weeks after you mail a paper return. The due date for returns and tax payments is April 18 2022.

Estates Trusts and the Deceased. Deduct the amount of tax paid from the tax calculation to provide an illustration of your 202223 tax refund. Here are some tips to make filing and getting your refund easier and faster.

Vermont Income Tax Withholding. Looking for a quick snapshot tax illustration and example of how to calculate your. This includes Social Security retirement benefits and income from most retirement accounts.

A Vermont resident or. Adding the 1 millionaires tax yields a top income tax rate of. Massachusetts Department of Revenue issues most refunds within 21 business days.

A nonresident of Vermont for services performed in. 202223 Tax Refund Calculator. Overview of Vermont Retirement Tax Friendliness.

Payments subject to Vermont tax withholding include wages pensions and annuities. Massachusetts Tax Deductions Income tax deductions are expenses that can be deducted from your gross pre-tax income. Looking at the tax rate and tax brackets shown in the tables above for South Carolina we can see that South Carolina collects individual income taxes similarly for Single versus Married filing statuses for example.

Property taxes in Vermont are among the highest in the nation but sales taxes are below average. Other payments are generally subject to Vermont income tax withholding if the payments are subject to federal tax withholding and the payments are made to. Vermont taxes most forms of retirement income at rates ranging from 335 to 875.

We would like to show you a description here but the site wont allow us. California state income tax rate table for the 2020 - 2021 filing season has nine income tax brackets with CA tax rates of 1 2 4 6 8 93 103 113 and 123 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. Calculate your total tax due using the tax calculator updated to include the 202223 tax brackets.

Refund verification whats that. If you received a letter from us about your tax return dont worry it doesnt mean you did anything wrong. We can also see the progressive nature of South Carolina state income tax rates from the lowest SC tax rate.

Vt Dept Of Taxes Vtdepttaxes Twitter

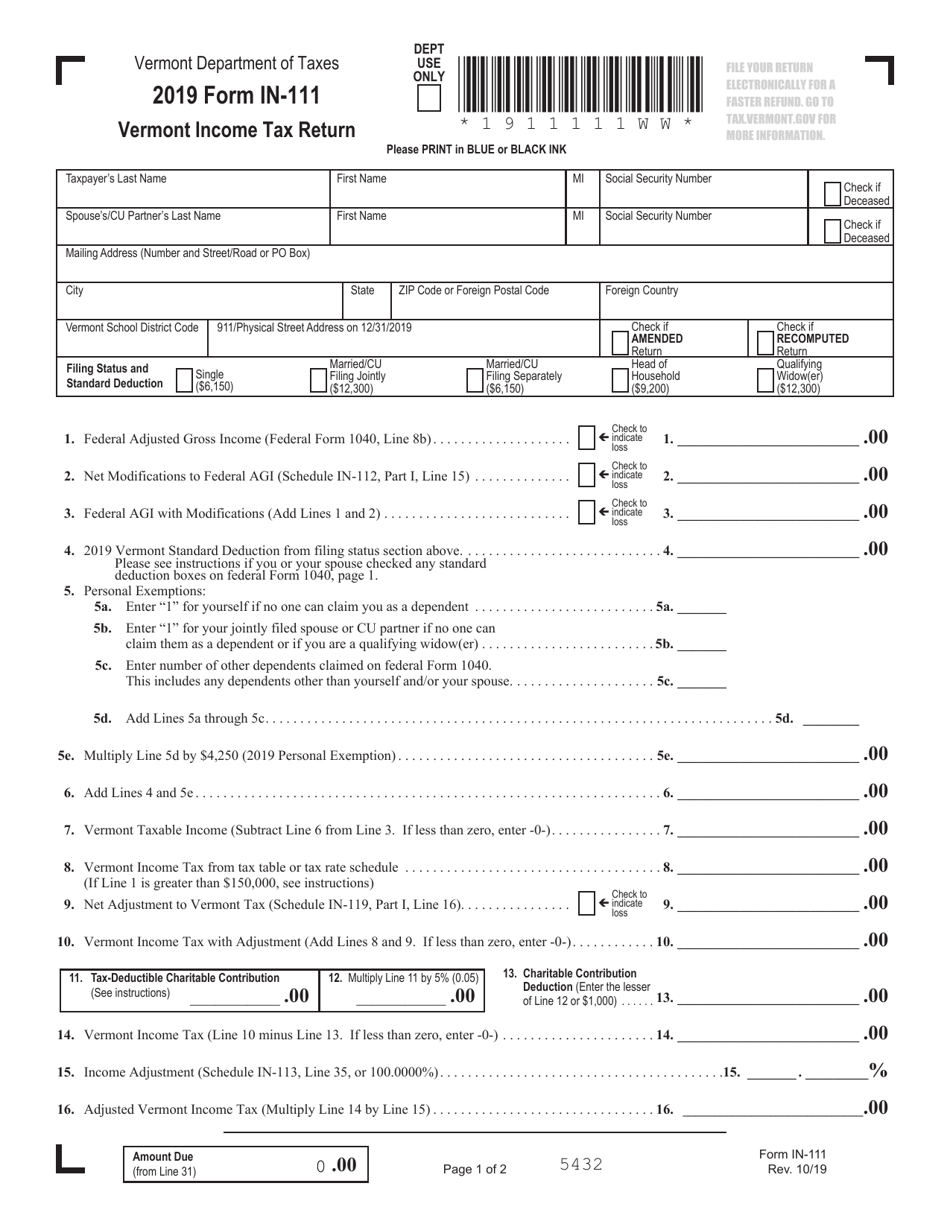

Form In 111 Download Fillable Pdf Or Fill Online Vermont Income Tax Return 2019 Vermont Templateroller

Individuals Department Of Taxes

Personal Income Tax Department Of Taxes

Vermont Tax Forms And Instructions For 2021 Form In 111

Your Tax Bill Department Of Taxes

Vt Form In 111 Download Fillable Pdf Or Fill Online Income Tax Return 2018 Vermont Templateroller

Personal Income Decline Drives Down General Fund Tax Revenues Vermont Business Magazine

Form In 111 Fillable Vermont Income Tax Return

Where S My Refund Vermont H R Block

Vt Dept Of Taxes Vtdepttaxes Twitter

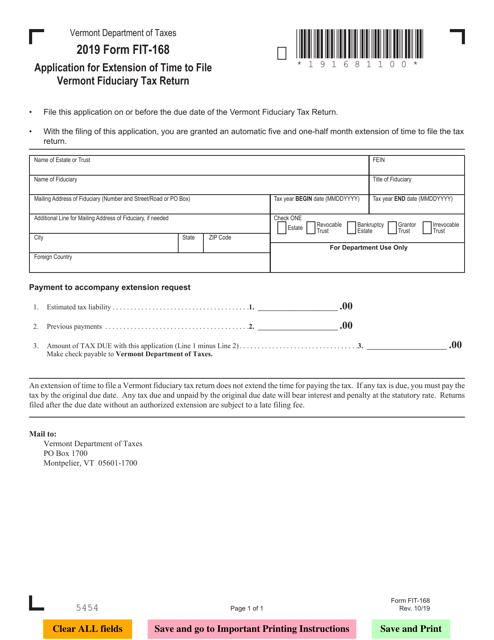

Form Fit 168 Download Fillable Pdf Or Fill Online Application For Extension Of Time To File Vermont Fiduciary Tax Return 2019 Vermont Templateroller

Filing A Vermont Income Tax Return Things To Know Credit Karma

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes